View Transcript

Episode Description

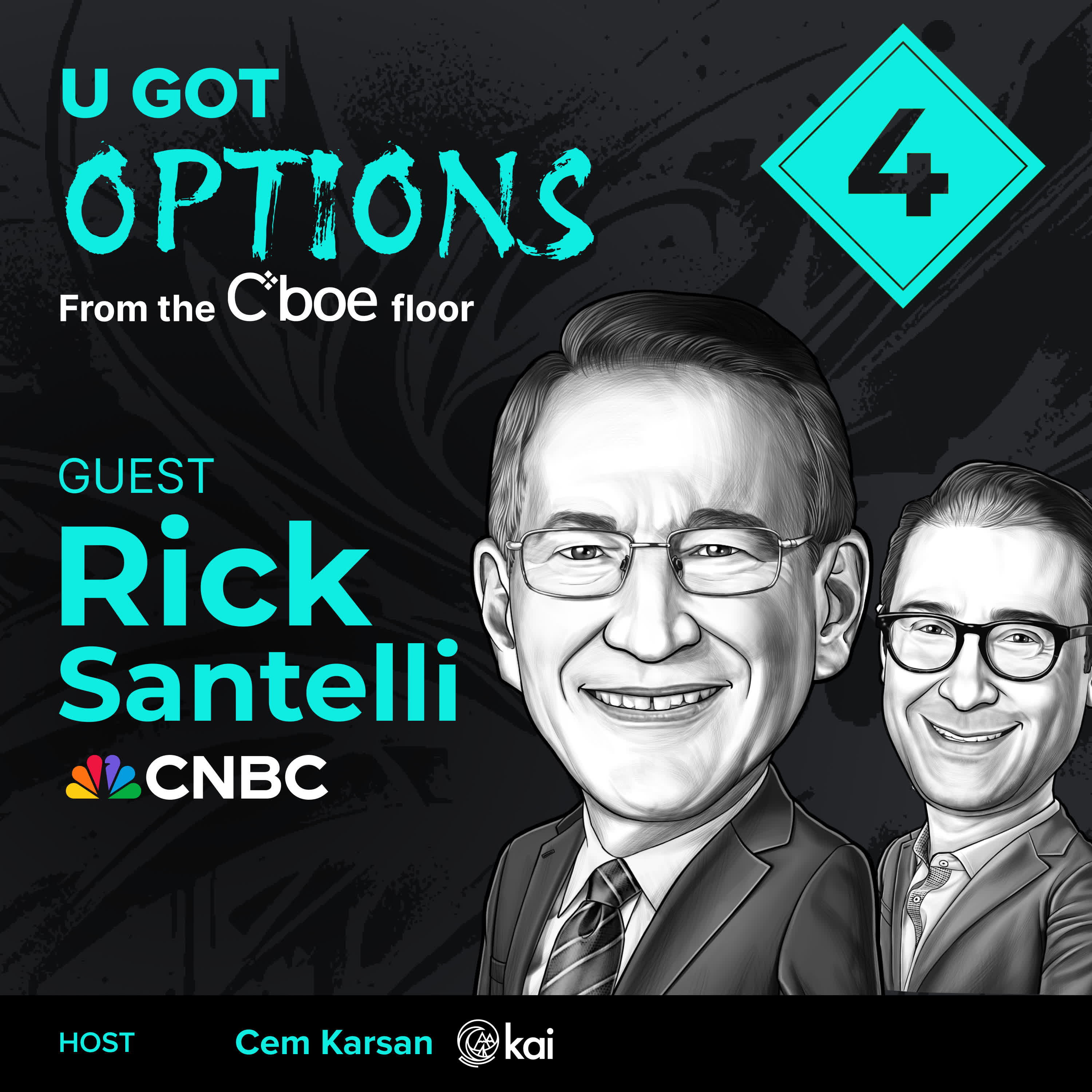

Rick Santelli joins Cem Karsan for a conversation that cuts through the noise. From the floor of the Cboe to the era of central bank primacy, Santelli reflects on how markets have been reshaped... not just by technology or policy, but by the loss of honest signals. They cover the Fed’s shift from restraint to control, the unintended consequences of zero rates, and why housing, credit, and the long bond may be nearing a breaking point. This isn’t a retrospective. It’s a clear warning from someone who’s seen what happens when incentives go unchecked.

-----

50 YEARS OF TREND FOLLOWING BOOK AND BEHIND-THE-SCENES VIDEO FOR ACCREDITED INVESTORS - CLICK HERE

-----

Follow Niels on Twitter, LinkedIn, YouTube or via the TTU website.

IT’s TRUE ? – most CIO’s read 50+ books each year – get your FREE copy of the Ultimate Guide to the Best Investment Books ever written here.

And you can get a free copy of my latest book “Ten Reasons to Add Trend Following to Your Portfolio” here.

Learn more about the Trend Barometer here.

Send your questions to info@toptradersunplugged.com

And please share this episode with a like-minded friend and leave an honest Rating & Review on iTunes or Spotify so more people can discover the podcast.

Follow Cem on Twitter.

Follow Rick on X.

Episode TimeStamps:

00:02 - Introduction to the UGO series

01:26 - Introduction to Rick Santelli

05:16 - The first trade Santelli ever made

06:32 - The historical performance of gold

08:39 - Why did Santelli move to interest rates?

10:28 - How technology impacts the way we invest

13:30 - A shadow Fed president

14:46 - How Alan Greenspan changed everything

18:47 - We are starting to pay the price of overspending

22:04 - Money printing - a daisy chain of a closed circuit

23:50 - How do we get out of debt and how does it end?

29:06 - How do you invest wisely in today's economy?

36:48 - Cost of credit: The lurking financial threat

39:03 - How young people should set themselves up for retirement

Copyright © 2024 – CMC AG – All Rights Reserved

----

PLUS: Whenever you're ready... here are 3 ways I can help you in your investment Journey:

1. eBooks that cover key topics that you need to know about

In my eBooks, I put together some key discoveries and things I have learnt during the more than 3 decades I have worked in the Trend Following industry, which I hope you will find useful. Click Here

2. Daily Trend Barometer and Market Score

One of the things I’m really proud of, is the fact that I have managed to published the Trend Barometer and Market Score each day for more than a decade...as these tools are really good at describing the environment for trend following managers as well as giving insights into the general positioning of a trend following strategy! Click Here

3. Other Resources that can help you

And if you are hungry for more useful resources from the trend following world...check out some precious resources that I have found over the years to be really valuable. Click Here