·S1 E22

What 62 Years of Experience Can Teach You About Financial Innovation

Episode Transcript

Ben Boyer: it's kind of like your first job.

You know, everybody has to have a first job.

Everybody has to have a first financial product to develop a credit history.

that's ultimately where people are going to be successful in the space

Tedd HuffTedd Huff: the idea of the DDA, not being that primary driver of that relationship.

really Make it.

A lifetime customer not I need it now type customer.

Ben BoyerBen Boyer: we've been around since 1962, obviously in the past five, 10 years, more alternative data coming in and more opportunity to understand your customer base It's really about finding the people that are falling through the cracks.

products have gotten into a little bit of regulatory hot water, is just around over promising and under delivering with what they can do companies that are maybe viewing that as a major profit center.

Are approaching it the wrong way exceptional customer service and continuing to offer them products that meet them where they are they were there for me when nobody else was

Tedd HuffTedd Huff: Here's a quick message from the Accrued Series sponsor.

As default rates continue to rise and margins compressed in lending, financial organizations are searching for solutions to combine that operational efficiency with innovation.

Look no further as LoanPro allows lenders to enhance their origination, servicing, collections, and payments using the foundation of a modern lending core.

Check out loanpro.

io to learn more about how over 600 financial organizations.

Have modernized their tech stack with LoanPro.

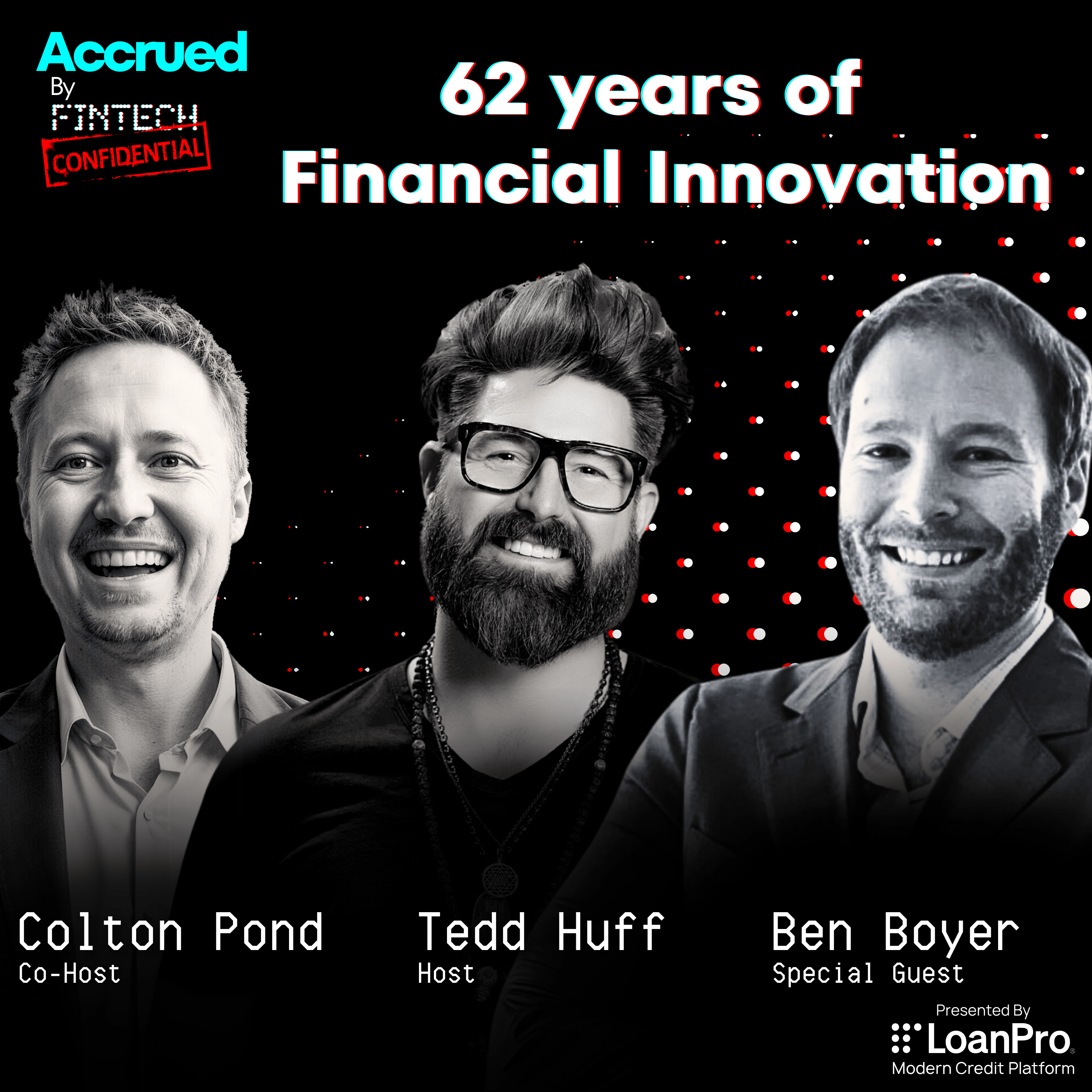

Welcome to Accrued, the fintech confidential series presented by LoanPro.

In this series, we're deconstructing the complexities of lending and exploring compliance, optimization, modernization, and personalization through insightful conversations with the industry's best.

I'm Tedd Huff, and with my co host Colton Pond, we'll be guiding you through the intricate lending world.

Whether you're deep into lend tech or just intrigued by how the technology is reshaping lending.

You're in the right place.

And now let's dive into another episode Of accrued.

Colton, this, we're out here on the salt flats at the strategic advisory board event.

I don't think I've ever done a podcast in an environment like this before, but I'm super stoked to be sitting down with Ben Boyer today to see what's going on in his world.

Colton PondColton Pond: Yeah, let's let's dig in Ben, so to have you, Ben leads a new product development at world acceptance, um, and excited to have you here.

Welcome, man.

Excited

Ben BoyerBen Boyer: to be here.

Thanks for having me.

Colton PondColton Pond: Yeah,

Tedd HuffTedd Huff: I want to start off by just understanding from your perspective, you guys have been in the business of, uh, Providing installment loans.

What are you seeing the market doing and how is that impacting the way that you're looking at moving the business forward?

Ben BoyerBen Boyer: Yeah.

So I think, you know, we've been around since 1962, um, we've been doing installment loan lending.

So I think we've really kind of focused on what I think are key.

Principles are, which is how can we help our customers and how can we provide them with the financial services that they need for wherever they are on their financial journey?

And so I think throughout time, you know, obviously since the sixties, there's been, boom periods and there's been bust periods and there've been plenty of companies that have come and gone, but I think we've really just tried to focus on how can we help serve our customers and how can we give them what they need?

And if we can do that, we're ultimately going to be successful.

Regardless of what the economic climate is.

Colton PondColton Pond: Yeah.

So one of the key themes on that note, Ben, and we've chatted a good amount here at strategic advisory board is the shift from organizations on offering one product to expanding.

And as we mentioned, you lead new product development.

Help us understand as you think about new product opportunities.

How do you prioritize what to go after and what that looks like?

Ben BoyerBen Boyer: I think it's really about putting yourself in the customer's shoes and asking yourself, what did they need?

You know, it's easy for us to sit in meeting rooms and try to whiteboard out all these products that we could come up with that, that we think would be cool.

But you know, we're not always the customers that can serve them, so we really have to put ourselves in the customer's shoes and say, What do our customers need when they walk into a branch or when they come into a website?

What are they looking at us to be able to help serve them with?

And how can we expand upon that to, to really help them grow their financial future?

Colton PondColton Pond: Yeah, and what's the job to be done, right?

Like, what jobs and pain points do they have?

What do they need us to solve?

And what I love about the shift from being a lot of organizations, uh, one product to multi product and increasing share wallet is exactly what you said.

If you can better serve the needs of the consumer, that's good for everyone, especially the consumer.

Ben BoyerBen Boyer: Right.

Absolutely.

Tedd HuffTedd Huff: How are you looking at moving the company forward and, and.

Where is an area you see as an opportunity, for the market to serve your customers better?

Ben BoyerBen Boyer: Yeah.

So I think for us, it's about.

You know having products that cater to our customers as they continue to progress up the financial journey that they're on so Really looking to how can we start with a customer who maybe has a really really thin file Or you know have some major derogatories on their credit report and how can we continue to offer them products?

They're going to be appealing to them and are going to be competitive with what they could get in the market right there because once we have a customer who's demonstrated that they have the capability to pay and be a good customer, we don't want to lose them to somebody else who's going to offer them a product that we can't.

So we want to have, you know, products that will compete and be good products that they want to have.

I make the cliche joke all the time, you know, we're probably never going to have airport lounges and be serving the, you know, the millionaires and the billionaires of the world with super prime offering.

But, you know, we want to be able to have somebody come in, uh, very early on in their journey and stay with us, know, for, for as long as they want to.

Tedd HuffTedd Huff: Yeah.

Colton, you know, it's interesting as I hear Ben talk about this is that a lot of the conversation that we've heard today, with The attendees as well as, the folks that are sharing their, their knowledge has been the idea of the DDA, not being that primary driver of that relationship.

And what I'm hearing from Ben is that they're taking that step to continue to extend that relationship beyond that installment loan beyond those pieces and really make it.

A lifetime customer not I need it now type customer.

Colton PondColton Pond: I mean, this is a great point and one that's As I pressure tested it with people a relatively controversial topic actually because I personally view my And so my i'll share a little bit about my financial life My direct deposit goes into both us bank and sofi But I actually don't consider my relationship with either of them I consider my primary relationship actually with american express

Tedd HuffTedd Huff: same here.

Colton PondColton Pond: All my transactions go through american express Sorry, like Airport lounges and things like that.

The world doesn't care But they know way more about me than us bank or sofi.

They see every single transaction in my life um and along those lines You Um, when we think about, uh, you all world and think about the credit builder has been a hot topic for fintechs for regulation for a variety of different ways.

where do you think the future of credit builder and building is going?

Ben BoyerBen Boyer: where those products have gotten into a little bit of regulatory hot water, um, or are starting to is just around over promising and under delivering with what they can do with regards to, improving a customer's credit, depending on how they come in and also how quickly they can do it and how much they cost.

And I think a lot of companies that are maybe viewing that as a major profit center.

Are approaching it the wrong way.

we view those products as introductory products to really get to know the customer and hopefully grow them into other products that are gonna have higher profit margins.

But, you know, we view those products as, you know, hopefully they're not loss leaders.

Hopefully you can break even on them, but we're not looking to generate massive amounts of revenue off of, you know, really the entry level products.

That's that's really about,

Colton PondColton Pond: How do you make sure that you keep the customer after that first year experience?

Tedd HuffTedd Huff: Support provided by Skyflow.

What if you could build fast, but not break privacy?

What if you could ensure data privacy, governance, and compliance with just a few API calls?

What if you could worry less about PCI requirements while actually improving privacy and security?

How much more time would your team have to truly innovate?

How much faster could you build and ship new features?

How much more powerful could your app be?

Skyflow is a ero trust data privacy vault delivered as an API.

Skyflow's radically simple design lets you use color.

secure and tokenized personal information like card data and payment details.

And with built in features like encrypted data analysis and sharing, anonymization and advanced governance, your days of choosing between data security and data usability are over.

Whether you're just concerned with PCI compliance.

or need to go further to include CCPA, GDPR, SOC 2, and beyond, SkyFlow has you covered.

What if you could build fast, but not break privacy?

With SkyFlow, you can.

Visit SkyFlowSecure.

com today to learn how.

Ben BoyerBen Boyer: It's really about providing them with exceptional customer service and continuing to offer them products that meet them where they are on that cycle.

And I think if you can do that, if you can find a way to have a really good relationship with the customer where they're not out looking for other financial products, and when you offer them something, they say, Hey, I like these guys, I've got a good relationship with them.

they were there for me when nobody else was.

You know, I'll, I'll, I'll keep everything.

You know, it helps if they have their logins and everything already set up and I don't want to reset those.

It's easier to stay.

Um with who you want to but I think that's really our goal is to to be the company that you want to stay with

Colton PondColton Pond: and then pricing becomes less of a factor because I know that i've had my Personal loan with world and they've treated me Well when I had a tough time and I I lost my job they were there and helped me through that Uh opportunity rather than saying, yeah Call me when you're 90 days delinquent and we'll chat about options, right which is a far different.

Uh, Approach.

Yep

Tedd HuffTedd Huff: And Colton, with you talking about being there, and you said meet them where they're at, what are some of the approaches that you take to make sure you're there, and you're meeting them where they're at, even if they don't know that they're there already?

Ben BoyerBen Boyer: Yeah, I think it's about, you know, understanding the customer, having interactions with the customer, and to your point, educating the customer, um, about, you know, You know what things they might be, able to get it at this point in their financial journey and what it looks like to get there.

really, when I think about what the future of the, fintech landscape looks like and product offerings, you know, we were talking and somebody mentioned, you know, this is a frustration that I know I had for a really long time is, you know, there's not really a good budgeting app that says if I have 100 in my bank account and I get paid X amount every two weeks, and I have these expenses like Am I going to run out of money?

If so, when, how much money do I need?

You know, if I add in this additional thing, what's that going to do to the budget?

So I think people that can deliver that type of education and common sense conversation to the customer to say, Hey, this is what it looks like.

This is what you need to do.

Here's how you can get there.

And yes, you, you can do this.

You can be control in control of your financial future and you can succeed.

the people who can tie those conversations into the right products for those customers are the ones that are ultimately going to succeed and win.

Colton PondColton Pond: Yeah.

Lastly, on that note, uh, key aspect there is understanding the customer through the data that you have and offering personalized products to meet them where they're at.

And that's a lot as we've met Ben that I've seen through Uh, you've been able to do and go on the journey of, Hey, where are my customers and how else can I help them?

Right.

Um, and how can I help them on the journey to what they want to achieve?

'cause ultimately every consumer doesn't wanna be in debt.

and in the end, lenders need to.

Help customers fulfill their goals, which is to get out of debt, right?

Tedd HuffTedd Huff: one last question Okay, because it's been as you and I were walking over You know, I I was kind of at i've asking a couple questions to better understand where you guys were at and I think the the piece that that was brought up is Is the credit worthiness piece of it?

And I want to know from your perspective How do you see?

The way we evaluate.

That worthiness, especially for the upcoming products that you all are working on, how has that changed and or changing in the next couple of years.

Ben BoyerBen Boyer: it's changed a lot, you know, obviously in the past five, 10 years, um, with, you know, more alternative data coming in and more opportunity to understand it, know more about your customer base, um, through, you know, platforms like finicity and plaid and, and those types of things.

And I think that's the direction that it's ultimately.

Going to continue to go in and, and the more information you can get about your customer's behavior and spending habits and patterns for things, and the more complete picture you can form about your customer without having to be.

Entirely reliant on a backwards looking credit score.

Um, that's always going to be a trailing indicator, which obviously those are fantastic products and they've served the market for really, really long time, but everybody has access to the same credit scores and everybody knows what everybody else is targeting from an underwriting model.

So it's really about finding the people that are falling through the cracks.

Of the large organizations that they just don't care about figuring out how to, find the right customers out of those populations and serve them with quality products.

Colton PondColton Pond: One of the aspects, a final thought on one of the conversations I had today, if you think about FICO score, it is one score for the broader population, and it's actually done a pretty damn good job at being relatively representative.

When you say, this is a score for everyone, everyone it works, right?

Right.

Uh, but where I see differentiation, what you're talking about is how do you take segments of the overall population and even your customer base and find alternative data that helps better inform creditworthiness, ability and willingness to repay and what, uh, portfolio performance would look like.

Ben BoyerBen Boyer: Yeah.

And how do you find low risk products that creditworthiness is even less of a factor?

How do you give the customer base that has.

No credit history whatsoever.

The opportunity to prove themselves.

You know, it's kind of like your first job.

You know, everybody has to have a first job.

Everybody has to have a first financial product to develop a credit history.

And how do you come out with products that can meet those customers while also not generating a tremendous amount of risk for your company?

I think that's ultimately where people are going to be successful in the space.

And we're hoping to be successful in the spaces is don't over promise and under deliver.

And, you know, be honest and upfront with your customers and help them.

I mean, that's, that's what we're all in the business to do.

And there's been a lot of conversation about that here at this meeting is, you know, we're all in this business to help our customers and serve them.

if you lose sight of that, you can get yourself in trouble.

And so my hope is that we can just make sure that we never lose sight of that.

Colton PondColton Pond: I agree.

Thanks for the time, Ben.

Really appreciate it.

Thanks.

Tedd HuffTedd Huff: Well folks, that does it for another episode of Accrued.

If you've made it this far, go ahead, like, share, subscribe, all that fun stuff.

And don't forget to sign up at fintechconfidential.

com to be alerted your favorite episode coming up next.

And as always, keep moving forward.